Discover structured, professionally managed investment opportunities that suit your financial goals, risk appetite, and time horizon.

Mutual funds are pooled investment vehicles where money from multiple investors is combined to invest in a diverse mix of assets such as equities, debt, gold, and real estate. This allows investors to access a broad portfolio managed by experienced fund managers, who make data-driven decisions to optimize returns while managing risks.

By investing in mutual funds, even individuals with limited capital or market knowledge can enjoy the benefits of professional management, diversification, and access to markets that may be otherwise difficult to reach.

Investing in mutual funds is straightforward. You can contribute via Systematic Investment Plans (SIPs) to make regular, disciplined investments, or opt for one-time lump-sum contributions for larger capital deployment. Our team ensures that the KYC (Know Your Customer) process is smooth and compliant, so you can start investing with confidence.

We help you choose funds aligned with your financial goals, time horizon, and risk tolerance, offering clear explanations of each option’s potential returns and risks. Whether you are a beginner or an experienced investor, JLP Wealth provides guidance at every step.

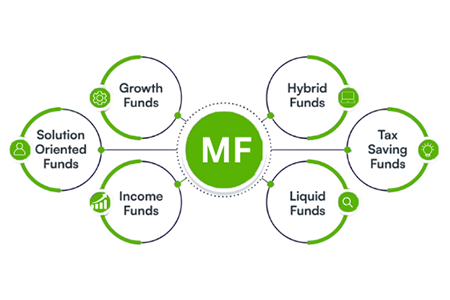

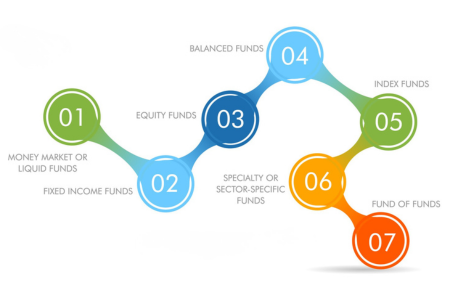

Mutual funds are designed to cater to different investment objectives and risk profiles:

With so many options available, it’s essential to select a fund that aligns with your financial goals and comfort with risk. JLP Wealth advisors guide you in creating a personalized portfolio for optimal diversification.

Mutual fund taxation depends on the type of fund and holding period:

Understanding taxation is crucial to maximize returns and optimize investment strategy. Our advisors provide guidance on selecting funds with tax efficiency in mind.

We simplify investment decisions, offering personalized strategies, research-backed guidance, and continuous portfolio support to help you achieve long-term financial security.

Talk to an Advisor