At JLP Wealth Services, we simplify your investment journey and help you make informed financial decisions.

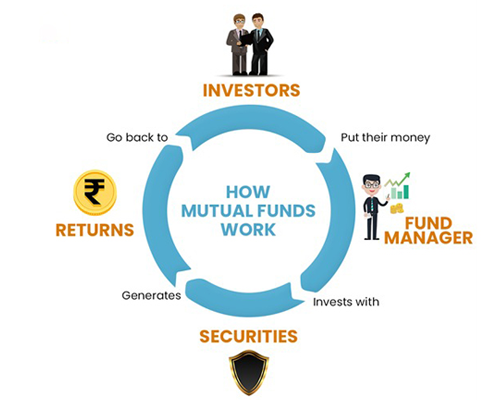

As an AMFI-registered Mutual Fund Distributor, our focus is on helping investors execute, monitor, and manage their mutual fund investments effectively — with transparency, discipline, and care.

We offer a wide range of mutual fund investment options from leading fund houses across India. Whether your goal is wealth creation, stable income, or capital preservation, we help you select suitable schemes that align with your needs.

A SIP is one of the most effective ways to create long-term wealth through disciplined investing. We help investors start and manage SIPs for various financial goals.

Every investor has unique financial goals — be it buying a house, planning for a child’s education, or building a retirement corpus. We help map your goals and create suitable investment execution plans.

Investing is a journey. We review portfolios regularly to keep you aligned with your goals and suggest rebalancing when needed.

We make investing 100% paperless and secure through trusted online platforms like BSE Star MF, NSE NMF II, and MF Utility.

We help investors make the most of Section 80C through Equity Linked Savings Schemes (ELSS) — combining tax-saving with long-term wealth creation.

We believe that an informed investor is a confident investor. We regularly share educational resources on mutual funds, SIPs, and financial planning.

We believe in Save | Invest | Grow — a simple yet powerful philosophy promoting disciplined saving, long-term investing, and sustainable wealth creation. Our services ensure your money works harder for you — conveniently and transparently.

JLP Wealth Services is an AMFI-registered Mutual Fund Distributor (ARN: 319379). We do not provide investment advice or guaranteed returns. All investments are made at investor discretion and are subject to market risks. Please read scheme documents carefully before investing.